With 37.21% of its users in France according to 6sense and a global market share of 1.91%, PrestaShop dominates the French e-commerce ecosystem. According to official data, 50% of French e-commerce sites use this open-source solution.

You are the architect of your own success. On PrestaShop, you have built your store, chosen your modules, and optimized your code. But this expertise often stops at the warehouse door. ManagingPrestaShop parcel insurance then becomes a complex patchwork, a source of "technical debt" and wasted time.

This article is not a list of modules to add. It is a radical simplification strategy. We will show you how to escape the chaos of siloed parcel insurance and adopt a unified solution that protects 100% of your shipments with less than 20% of the technical effort. See also our article comparing the parcel insurance offerings of different CMSs.

The PrestaShop Ecosystem in 2026: Opportunities and Challenges for Delivery Insurance

The PrestaShop Marketplace in Figures

Key points: PrestaShop represents a mature ecosystem with a strong concentration in France (37.21% of global users). The growth in the average French shopping cart (+2.7% in 2024) reflects a move upmarket that requires parcel protection adapted to increasing values.

PrestaShop User Profile Type

According to Store Leads analysis, PrestaShop stores are distributed as follows:

- 18.2% sell 1-9 products (very small businesses, artisans, designers)

- 15.5% sell 100-249 products (established SMEs)

- 14.9% sell 250-999 products (retailers )

This diversity creates highly varied parcel insurance needs that "one-size-fits-all" solutions cannot effectively meet.

Chaos by Default: Parcel Insurance on PrestaShop

Unlike closed SaaS platforms, PrestaShop does not offer any unified "native" parcel insurance solutions. You, the merchant, are left to deal with a fragmented reality on your own:

Fragmentation Carriers

- As many processes as there are carriers: Your Colissimo module offers a parcel insurance option. Chronopost offers another ad valorem insurance Chronopost with Limits . GLS may not offer any insurance options. This means you have to juggle between several interfaces and claims processes.

- Fragmented management: A dispute over a package with Colissimo? You deal with La Poste. A problem with damaged goods shipped with UPS? You enter the UPS process. There is no centralization, no overview of your risks, and your teams have to relearn the processes.

- Compensation delays that weigh heavily on cash flow: Each Carrier its own reimbursement period, often exceeding 60 days. During this time, you have already had to satisfy your customer and reship a product without any certainty of being compensated.

The Illusion of "Dedicated" Modules on the Marketplace

The first temptation for a PrestaShop merchant is to look for an ad valorem insurance solution on the Add-ons marketplace. This is a strategic mistake that responds to complexity with more complexity.

Marketplace Modules Issue: These solutions handle pricing but not the actual management of transportation claims. You pay for the module, configure the pricing, but in the event of an actual claim, you revert to traditional carrier processes with their delays and exclusions.

The Hidden Costs of Insurance Modules for Your Shipments

Adding a parcel insurance module to a PrestaShop stack is like adding a new part to an engine without checking its compatibility. Each module is a potential new source of conflicts and slowdowns, and a new element to update and maintain. It's the embodiment of technical debt, and you don't need that on top of your parcel delivery insurance.

The marketplace's insurance modules have three major hidden costs:

- Technical Cost: Modules must be purchased, often through a subscription. They slow down your site, require updates (which sometimes come at a cost), and may conflict with your other modules with each new version of PrestaShop.

- The Cost of Captivity: These modules are often tied to a specific Carrier insurer. You remain trapped in a claims process that you have no control over.

- Opportunity Cost: The time spent configuring, maintaining, and using these various parcel insurance modules is time you are not spending on developing your business.

Claisy, the alternative to Prestashop ad valorem insurance: the lightweight solution that unifies and protects your deliveries

There is a radically different approach, designed for PrestaShop architects who value performance and simplicity. Claisy is not a heavy module that adds to your stack. It is a smart, lightweight layer of protection that works in the background to secure your packages.

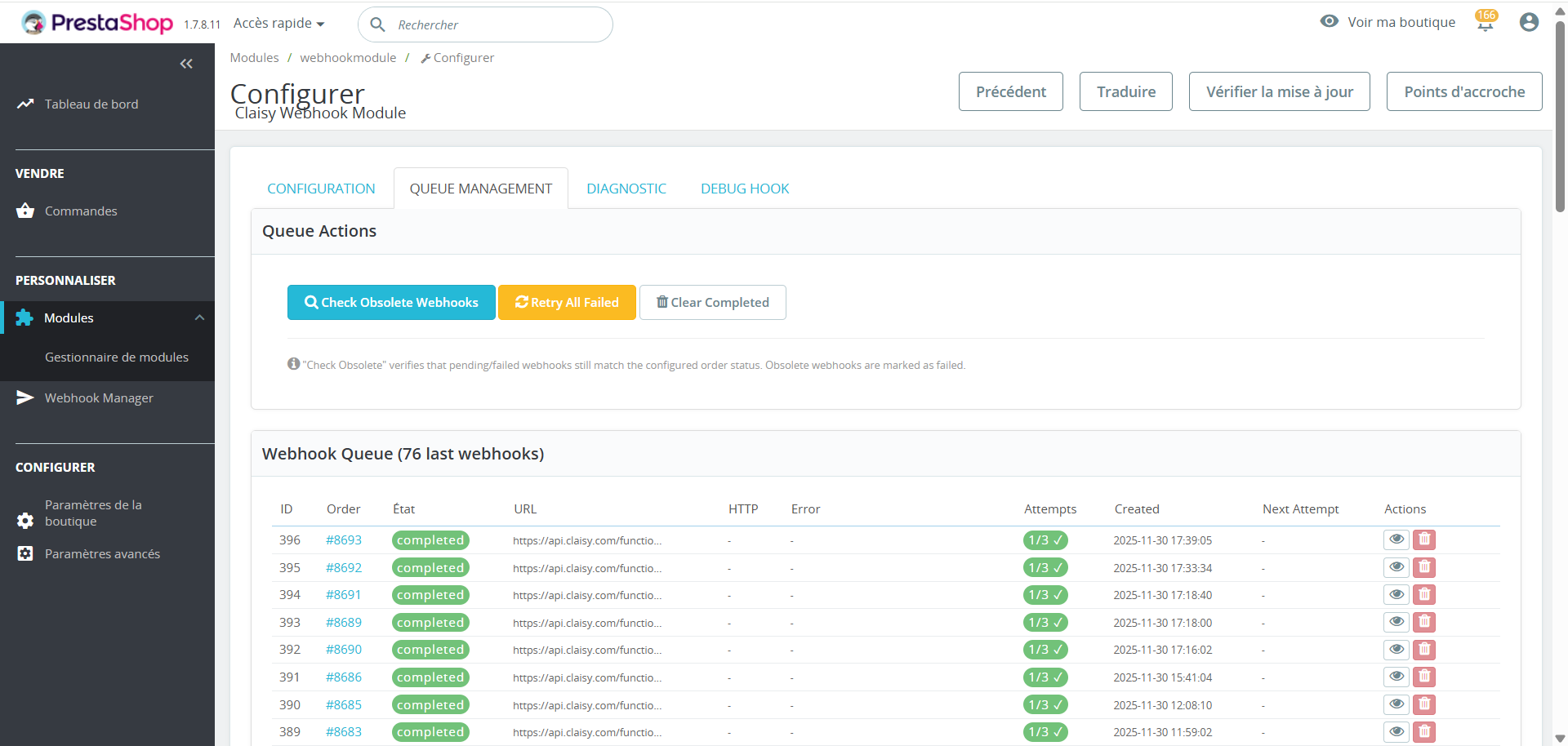

- Zero Technical Debt: Claisy integrates via a small free module (not available on the marketplace) that does only one thing: it "listens" to your shipment creations. There is no impact on your site's speed and no potential conflicts.

- Absolute Centralization: It doesn't matter whether you ship your package with Colissimo, Chronopost, UPS, DHL, or another carrier. All your insured packages are visible on a single dashboard. A single claims process. A single interface.

- No Disruption to Your Processes: You continue to create your labels using your usual carrier modules. Claisy automatically detects shipments and insures them in the background, without any manual action on your part.

- Superior Protection: Benefit from full Ad Valorem coverage (including luxury and high-tech items) with Limits ($115,000), and above all, compensation in less than a week, protecting your packages against loss, theft, and damage, and therefore your cash flow and brand image.

Universal Parcel Delivery Insurance All Carriers

🚚 The PrestaShop & Claisy partnership works with all carriers.

Unlike marketplace modules that are limited to certain carriers, Claisy automatically covers all your shipments regardless of the Carrier :

Don't just insure your Prestashop packages, start managing your risk

In 2026, the performance of a PrestaShop store will no longer be measured solely by the speed of its front office, but also by the efficiency of its back office. Continuing to manage parcel insurance in a fragmented manner means accepting a loss of time, money, and control.

The "Radical Simplification" of Prestashop parcel insurance is not a compromise, it's a strategy. Choosing Claisy means choosing a tool that unifies, automates, and protects your shipments, freeing up your time and resources so you can focus on what you do best: building and growing your e-commerce empire with reliable delivery insurance that matches your efforts.

Appendix

Queue Management Claisy in Prestashop

Case Study: Economic Impact of Your Parcel Insurance

Example 1: retailer TPE

📊 Profile: Fashion store, 100 packages/month, average basket value €85

Current Situation (Modules + Transporters)

- Insured Shipping Module: €79 purchase + €20/year maintenance

- Colissimo insurance: 2.3% (80% of shipments) = $156/month

- Chronopost : 1.8% (20% of shipments) = €31/month

- Refund timeframe: 45-90 days depending on Carrier

- Total cost: $200/month + management complexity

🟢 Unified Solution (0.75%)

- Single rate: $85 × 100 × 0.75% = $64/month

- Monthly savings: €123, or €1,476 per year

- Refund timeframe: 48 hours guaranteed

- Management: Single interface, zero modules

Result: 66% savings + major operational simplification

Example 2: Multi-product SME

📊 Profile: 250 references, 300 packages/month, average basket value €150

🔴 Fragmented Situation

- 3 different modules: €200 setup + €60/year maintenance

- UPS insurance: 1.05% + €12 minimum on 40% of shipments

- DHL insurance: 1.2% on 35% of shipments

- Postal service: 2.1% on 25% of shipments

- Weighted average cost: ~$650/month

- Time management: 8 hours/month (3 different interfaces)

🟢 Centralized Solution

- Single rate: $150 × 300 × 0.75% = $337/month

- Savings: €213/month, or €2,556/year

- Time management: 1 hour/month (single interface)

- ROI time: 7 hours/month × $35 = $245/month recovered

Total impact: €2,556 in direct savings + €2,940 in time saved = €5,496/year in savings

.svg)