"Your package is on its way." Three words that should be synonymous with satisfaction. Yet for millions of shippers, they mark the beginning of a period of anxiety. Will the package arrive? In what condition? And if it is lost or stolen, who will pay for the damage?

When analyzing logistics flows and friction points in e-commerce, it quickly becomes clear that transport disputes impact shippers' profitability: the biggest mistake is therefore to believe that all shipments are equal. Insured parcel delivery is not just an option; it is a strategic decision that separates amateurs from professionals, those who suffer the risks from those who control them.

France market data for 2025:

- 2.3 billion parcels shipped

- Average loss ratio: 2-3% depending on sector

- Total cost of uninsured claims: €450 million/year (e-commerce SMEs)

- 35% of customers do not return after a bad experience (source: study)

Detailed financial impact:

- Average cost of an e-commerce claim: €180 (shopping cart + reshipment + after-sales service time)

- Average cost of a B2B claim: €2,500 (critical part + production stoppage)

- Indirect impact: Customer lifetime value (CLV) loss = $50–$150

Actual Cost of Loss = Product Value + Reshipment Costs ($6-$15) + Customer Service Time ($15-$30) + Customer Impact ($50-$150)Example: Lost package worth €150 = €150 + €10 + €20 + €80 = €260 actual loss

This guide is not just a page of information. It's your complete roadmap for navigating the world of parcel insurance, understanding its pitfalls and choosing the protection that will truly secure your money, your time and your reputation.

Why insure your parcel delivery? The harsh reality of transport

The question is no longer "should you insure?", but "can you afford not to?". The explosion of e-commerce has automatically increased the risks and therefore raises the question of whether to send insured or uninsured parcels.

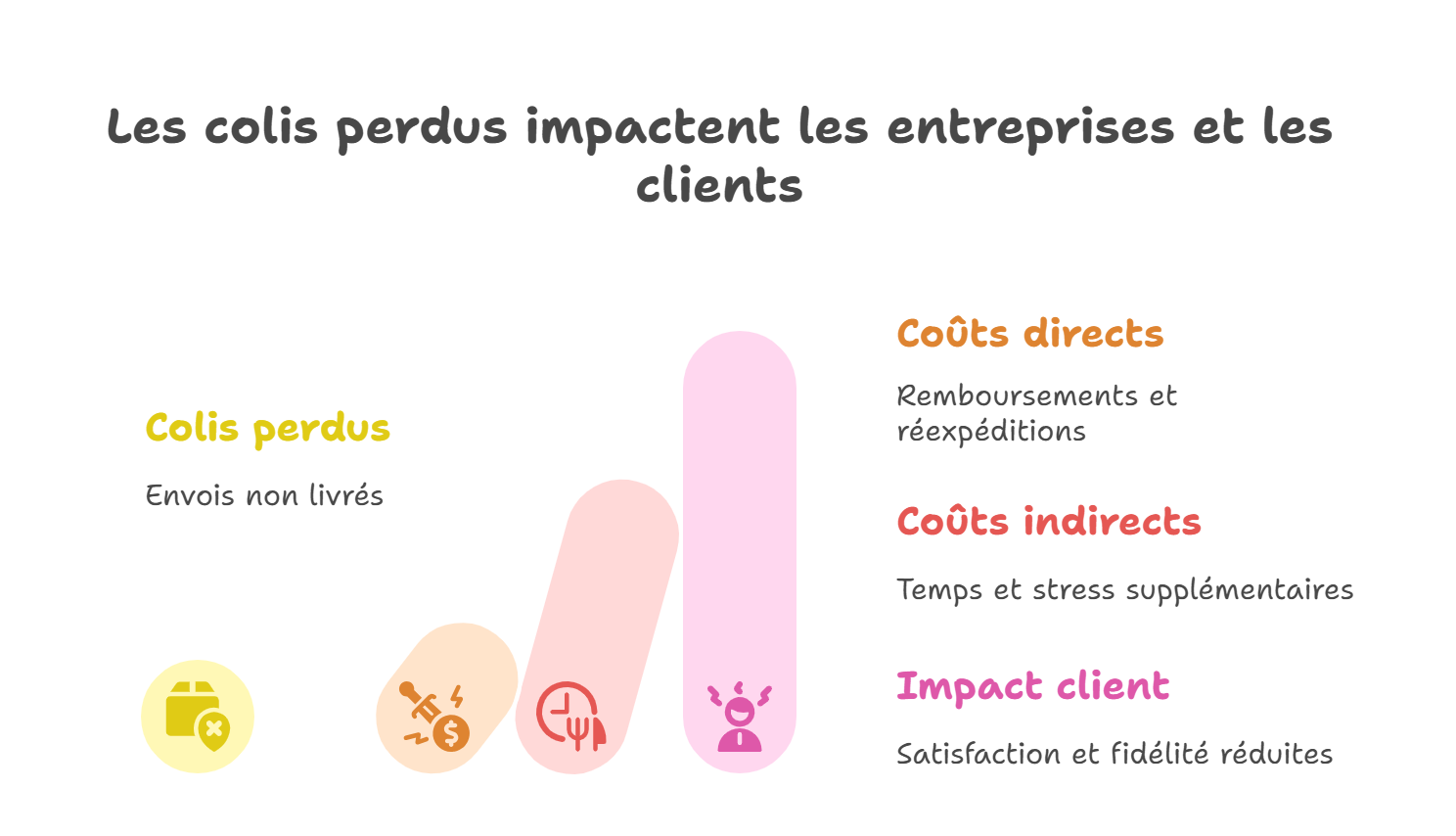

- The Numbers Don't Lie: Every year, millions of packages are reported lost, damaged, or stolen. The total cost of these losses amounts to billions of euros for retailers alone.

- Financial impact: A lost, uninsured parcel means a double deadweight loss: the value of the goods AND the cost of reshipment. Your margin evaporates instantly.

- Impact on Reputation: Over 35% of customers will not recommend a site after a poor delivery experience. A poorly managed dispute means a customer lost for life, and a potential negative review.

The main parcel insurance families: Don't fall into the trap

There are two radically different philosophies when it comes to parcel delivery insurance. Understanding this distinction is the first step in deciding whether or not to ship your parcels with insurance.

1. Basic" Carrier Insurance: A False Good Idea

All carriers (Colissimo, Chronopost, etc.) include basic "insurance". Beware, it's a trap.

- How it works: It's a flat-rate compensation, generally based on the weight of the parcel (e.g. €23/kg).

- The problem: For a 200g smartphone worth €1,000, you would be reimbursed... less than €5. It is illusory "protection," designed for low-value goods.

2. Delivery Insurance: The Only Real Protection

This is the standard for professional insurance. "Ad Valorem" means "according to value".

- How it works: You declare the actual value of your shipment, and are indemnified on this basis in the event of a claim.

- The advantage: Whether your package contains jewelry, artwork, or high-tech equipment, its value is truly protected (subject to conditions).

3 existing models:

A. Ad Valorem Carrier Option):

- Cost: 1-3% of value

- Limits €5,000–10,000

- Exclusions: Numerous

- Transport dispute compensation period: 60-90 days

B. Ad Valorem Platform (Sendcloud, Boxtal, Upela, etc.):

- Cost: Varies depending on partner

- Limits €5,000–20,000 (depending on partner)

- Transport dispute compensation period: 50-90 days

C. Specialized Ad Valorem (Claisy):

- Cost: 0.6-0.9% of value

- Limits €100,000

- Exclusions: Minimal

- Transport dispute compensation timeframe: 48-72 hours

5 Key Points for Comparing Parcel Insurance Offers

Now that you know you need Ad Valorem insurance, how do you choose the right one? Here's your comparison checklist.

- Limit of Indemnity: How much are you really covered for?

- Pricing and business model: Is cost a fixed percentage of value? Are there any hidden charges or subscriptions?

- Covered items and exclusions : Is your type of product (luxury, pre-owned, high-tech) explicitly covered? Read the fine print!

- Claims management: Is the claims process quick and easy? Do you obtain compensation within 72 hours or 3 months?

- The Target: Is the offer adapted to individuals, SMEs, or large volumes?

Comparison of the Best Parcel Delivery Insurance Policies

The market is divided into two camps: insurance offered directly by carriers and insurance offered by independent specialist insurers. For more details, please consult our comprehensive comparison of ad valorem 2025 insurance policiesand the focus on all parcel insurance offers on our hub (Carrier, CMS, Transport Broker, etc.).

The major point of differentiation: Specialized insurance solutions like Claisy have built their model to fill all the gaps left by carriers, allowing you to ship all your insured packages, even when carrier insurance excludes your merchandise. They offer not only better coverage at a better price, but also technological tools (connection to Shopify, PrestaShop, Magento, etc.) to fully automate parcel insurance management, which is impossible with carrier offers.

Which Parcel Insurance Should You Choose Based on Your Profile?

Find out more about our interactive carrier insurance comparator here

- Are you a private individual who occasionally sends a valuable object? Your Carrier 's Ad Valorem option may suffice, but compare its cost with that of a specialized insurer.

- Are you a retailer small business/SME)? A specialized insurer is the only viable solution. It protects your margin, your time, and your reputation. Automation via CMS connector is a huge productivity gain in managing your transport disputes.

- Do you ship luxury goods, high-tech items, or secondhand goods? Carriers often exclude these items. Only a specialized insurer like Claisy will offer you adequate coverage to insure yourpackages.

- Are you a marketplace? Customer experience is essential, and so is protecting your sellers: discover how Claisy can revolutionize your protection of sellers and buyers—digitize your transport dispute process.

Practical Guide: How does Delivery Insurance work?

Subscription: How do I insure my packages?

How to Insure a Package: 3 Detailed Methods

METHOD 1: Via Carrier Colissimo Example)

Step 1: Connect your Carrier interface Carrier example: Colissimo

- Go to www.colissimo.fr/particuliers

- Create your shipping label online

Step 2: Select the "Declared Value" option

- Check the box "Declare a value"

- Enter the exact amount (based on invoice)

- Maximum: €1,000 for Colissimo Domicile (for individuals)

Step 3: Cost calculation

- System automatically calculates: ~2% of the value

- Example: Package €500 → Insurance ~€10

Step 4: Confirmation and payment

- Confirm

- Pay for shipping + insurance

- Print slip marked "Declared value"

⚠️ Limitations:

- Limit of Limit ,000 insufficient for luxury goods

- Jewelry/watches often excluded

- Compensation period: 60-90 days

METHOD 2: Via Platform (Sendcloud Example)

Step 1: Set up your Sendcloud account

- Connect your Shopify/WooCommerce store

- Access insurance settings

Step 2: Activate delivery insurance

- When entering your label, indicate whether you wish to take out insurance.

- Enter the exact amount (based on invoice)

METHOD 3: Via Claisy (Automatic - Recommended)

Step 1: Create a Claisy account (2 min)

- Registration on claisy.com

- Email validation

- Documents: SIRET, bank account details

Step 2: CMS connection (5 min)

- Shopify: Install Claisy app

- WooCommerce: Install plugin

- PrestaShop: Install module

- Magento: Install extension

- Set automatic coverage thresholds: "Automatically insure if value >$100"

Step 4: Let's go!

- Each order is automatically insured according to your rules.

- Real-time dashboard: View all your insured packages

- 0 manual action

Transport dispute declaration

Be sure to check the eligibility requirements and dispute reporting procedures. At Claisy, the conditions are simple: for orders over €1,000, delivery must be made with a signature AND no indication of value should appear on the outside of your package (including on the shipping label)!

Next, if a dispute does arise, here are the four key areas where you should focus your efforts:

- Respect deadlines! You generally have 48 to 72 hours after delivery to report damage or theft, and a longer period (e.g. 30 days) for loss.

- Gather evidence: purchase invoice, proof of shipment, photos of damage, affidavit, complaint lodged if necessary.

- File your claim on your insurer's platform

- Follow up the case and wait for compensation. A good insurer will reimburse you in a matter of days, not months.

To find out more about managing disputes with Claisy, click here.